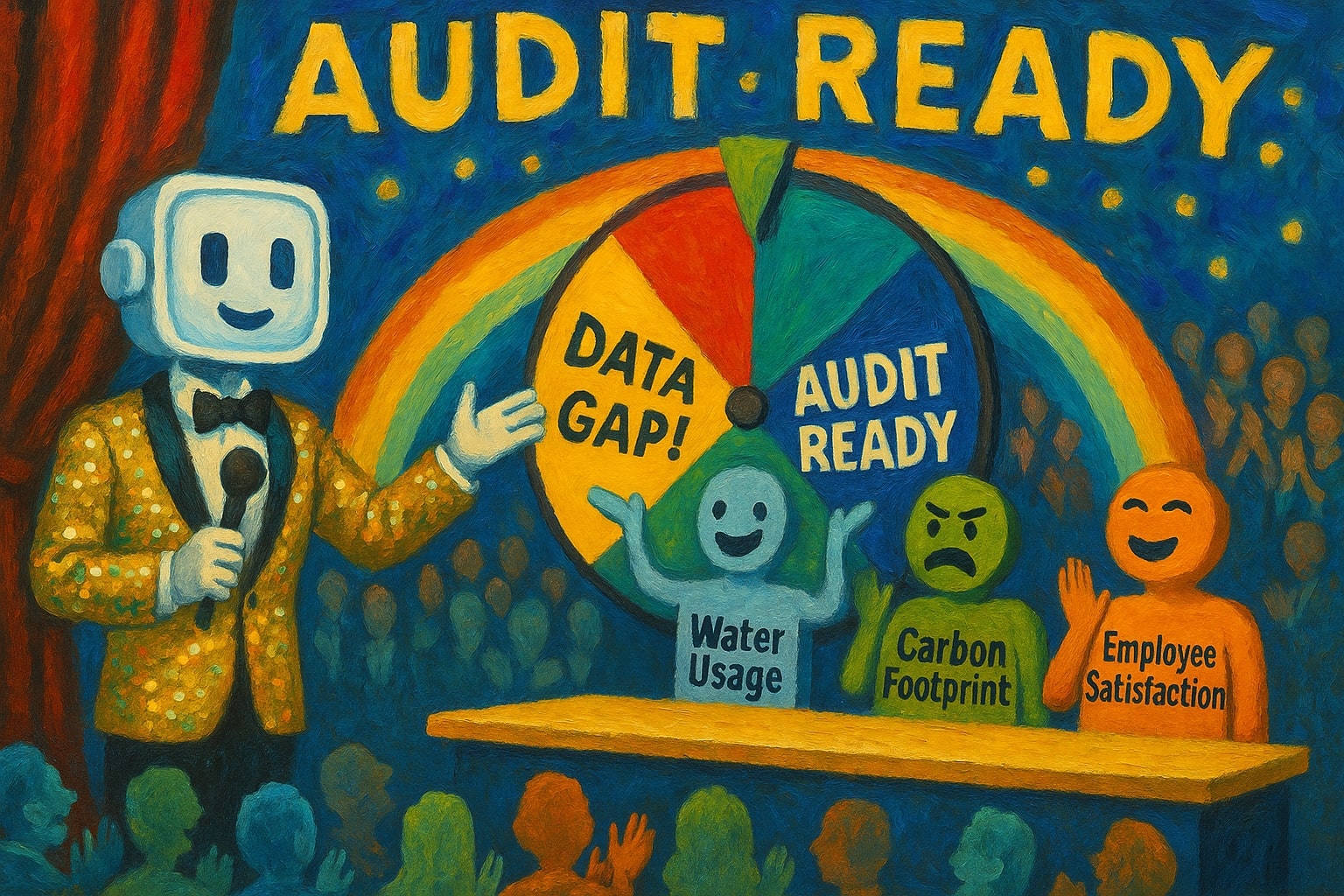

?Auditors today are under more pressure than ever. With sustainability reporting becoming more regulated, more complex, and far more scrutinized, assurance engagements have stepped into new territory. Thanks to the EU’s Corporate Sustainability Reporting Directive (CSRD), your job doesn’t stop at verifying financials; you’re now responsible for deep dives into ESG (Environmental, Social, and Governance) data too. That means more disclosures, more frameworks, and yes, more work.

To keep up, many audit firms encourage companies to leverage auditable ESG software to tackle the complexity head-on and stay efficient.

Why ESG Audits Are Getting Harder?

One of the biggest headaches right now? Dealing with reports built on multiple ESG frameworks. It’s common to see companies reporting using a mix of GRI, SASB, TCFD, and of course, the mandatory ESRS under CSRD. Each framework has different rules, metrics, methodologies, and expectations, so as an auditor, you’re left interpreting overlapping or even conflicting guidance, evaluating what’s material in each context, and trying to make the whole thing consistent. According to IFRS and SASB, many companies combine frameworks to satisfy both investor pressure and regulatory demands.

Then there’s the data challenge. Whether you’re working with a small business or a multinational, ESG audits now require a level of traceability, accuracy, and completeness that goes far beyond traditional financial audits. Unfortunately the data is often messy, spread across departments, poorly documented, and especially weak when it comes to supplier disclosures. This fragmented data landscape doesn’t just slow things down! It opens the door to missed risks and endless email chains trying to chase evidence. Both DataSnipper and EcoActive TechTech call out this very issue as a leading challenge in modern ESG assurance.

And just to make it all more fun, there’s a global talent shortage in the audit world. As noted by IPS Finance, audit firms are struggling to hire and retain professionals with the right ESG skillset. This comes at the worst possible time as demand for ESG assurance is exploding. The The Australian Financial Review adds that long hours, regulatory stress, and limited ESG training are pushing audit teams to their breaking point.

How the Right Software Can Help

That’s why many audit professionals are starting to lean on ESG data management & reporting software, not just as a reporting tool for clients, but as a strategic, cost-efficient solution for assurance teams. Platforms like Yodiwo’s EnGage help clean up the chaos: they structure data, centralize evidence, streamline supplier inputs, and even use AI to spot anomalies and assess audit readiness.

In the sections below, we’ll break down 5+1 specific ways ESG software like EnGage can make your life easier helping you deliver faster, more accurate audits in a world where ESG is only getting more complex.

1.Structured Data Collection Aligned with any Framework

A top challenge for auditors is ensuring that ESG disclosures are aligned with the required frameworks including the Double Materiality Assessment (DMA). Inconsistent data sources and lack of documentation make this even harder in real-world audit conditions.

An ESG software like EnGage helps companies structure their disclosures from the ground up in line with ESRS and other standards like GRI and SASB simultaneously. It guides the collection of both qualitative and quantitative data, ensures it is sourced from validated inputs, and applies version control to maintain integrity over time.

For auditors, this means less detective work and more confidence. You get clean, structured data with embedded context, making verification faster and reducing errors or misinterpretations.An ESG Software turns messy ESG narratives into standardized, auditable outputs saving valuable audit hours.

2.Comprehensive and Transparent Audit Trails

Without a clear audit trail, ESG assurance becomes a maze of emails, spreadsheets, and undocumented assumptions.

Auditors need to validate not just the figures but how they were calculated, by whom, and using what methodology.

Solutions like EnGage solve this with built-in traceability for every data point. The platform automatically logs metadata such as source system, contributor, timestamps, and the applied calculation methodology. Auditors can drill down into any figure and instantly see its origin without back-and-forth communication or delays.

This detailed transparency doesn’t just simplify evidence collection it reduces the risk of errors or omissions, improves the quality of the assurance provided, and shortens the audit lifecycle.

3.Efficient Supplier Data Management

One of the most significant bottlenecks in ESG assurance is assessing supplier-level data. Often, supplier disclosures are inconsistent, non-standardized, or missing entirely leaving auditors to patch together fragmented insights.

Dedicated supplier engagement modules like the one EnGage includes standardizes ESG data collection across the entire value chain. The platform sends customizable questionnaires to suppliers, guides them through the reporting process, and consolidates their responses into structured, auditable formats.

For you, this means cleaner, comparable data at scale. It enables a more accurate view of Scope 3 emissions, labor practices, and overall supply chain ESG risks, all while reducing manual validation and reconciliation work.

4.Dedicated Auditor Access and Data Security

Audits often stall when data access is cumbersome, disorganized, or insecure. Emailing spreadsheets back and forth risks version control issues and slows down the process. Even worse, open access to live systems can compromise data integrity.

Some platforms like EnGage, provide a secure, read-only auditor interface, purpose-built to streamline ESG assurance. Auditors are granted dedicated access to exactly what they need—supporting documentation, evidence layers, and justifications—without the risk of data being altered or overwritten.

5.AI-Assisted Scoring & Anomaly Detection

Manually spotting red flags in large ESG datasets is not only inefficient, it’s increasingly impossible. As ESG data volumes and dimensions grow, so does the potential for human oversight.

Leveraging AI to proactively scan for inconsistencies, missing data, and unusual patterns can be life-saving. For example, EnGage offers anomaly detection that flags deviations from historical norms or industry benchmarks, helping auditors and reporting teams pinpoint high-risk data points instantly. Simultaneously, an AI-driven scoring engine can evaluate overall data quality or framework alignment.

This transforms how users engage with data from reactive reviewers to proactive analysts.

+1 Bonus Reason: AI-Powered Audit Readiness Assessments

Beyond the data itself, auditors also need to assess how prepared an organization is for ESG assurance. This includes evaluating internal processes, data quality, documentation completeness, and governance.

EnGage is pioneering an AI-powered audit readiness assessment that does exactly that. The tool provides a comprehensive score of how prepared the organization is based on factors like data traceability, completeness, and framework adherence along with tailored recommendations for improvement.

For auditors, this is a powerful starting point. It allows them to scope their work more effectively, allocate resources to higher-risk areas, and start engagements with a clear understanding of where the reporting entity stands. For clients, it provides clarity on expectations and fosters a more collaborative, focused audit process.

Conclusion: Making ESG Assurance Simpler and More Effective

Yeah we get t! Auditors are being asked to do more with tighter deadlines. Heavier regulations. More frameworks. Less staff. And now, with CSRD and ESG data flying in from all directions, audit work isn’t just complex, it’s becoming a full-on marathon.

This is where an ESG Data management and reporting software becomes not only for your client but also for you a not-so-secret weapon that doesn’t just clean up messy ESG data! It gives auditors exactly what they need: clarity, structure, traceability, and yes, sanity.

No more:

💡 chasing clients for Excel files.

💡 second-guessing how a data point was calculated.

💡 wasted hours trying to make sense of supplier reports from 15 different countries.

A platform like EnGage by Yodiwo automates what used to eat up your audit hours!

The result? You save time, reduce overhead, and get more done with fewer people without cutting corners.

Whether you’re reviewing ESG reports for a small local firm or a multinational conglomerate, the platform keeps your process consistent, repeatable, and cost-effective.